-

Dina Tedla published Business Day Quotes Eric LeCompte on the Solutions to the Debt Crises in Press 2024-02-13 14:09:18 -0500

Business Day Quotes Eric LeCompte on the Solutions to the Debt Crises

Business Day quotes Eric LeCompte on the solutions to the developing country debt crises at the IMF and World Bank. Read the excerpt below and click here for the full article.

Will World Bank, IMF rescue developing economies from growing debt conundrum?

By Kadiri Abdulrahman

At the Marrakech meetings, a coalition of faith-based organisations, Jubilee USA, urged the World Bank and the IMF to stop the debt and food crises of low-income nations.

Eric LeCompte, Executive Secretary of the group, said that it could be done by stopping the “ridiculous policies” of raising interest rates.

According to him, development banks can help address debt crises by ensuring that debt contracts have clauses where debt payments stop in the face of disasters and by promoting swaps, transparency and accountability.

Read more here.

-

Dina Tedla published World Leaders Focus on High Debt Levels and Poor Economic Growth as Morocco Meetings Begin in Press 2023-10-09 17:10:37 -0400

World Leaders Focus on High Debt Levels and Poor Economic Growth as Morocco Meetings Begin

World leaders, finance ministers, business groups, academics and development organizations descend on Marrakesh, Morocco, for the IMF and World Bank Annual Meetings. IMF head Kristalina Georgieva reports that the global economy lost $3.7 trillion due to shocks since 2020 and that slow and unequal growth continues.

“Debt, climate issues and poor economic growth top the agenda during these meetings,” said Eric LeCompte, Executive Director of the religious development group Jubilee USA Network. LeCompte is in Marrakesh for the IMF and World Bank meetings. “It's important that we are meeting in Africa where the average income hasn't changed since 2015 and the region is dealing with a serious climate crisis."

This is the first time since 1973 in Kenya that the IMF and World Bank Annual Meetings have taken place in Africa. The IMF, World Bank, G20 and G7 meet October 9th through 15th.

Read Jubilee USA's press release on IMF chief Kristalina Georgieva's curtain raiser speech here.

Join Jubilee USA and partners for IMF and World Bank event: "Defusing the Debt Time Bomb: The Role of an Effective Crisis Prevention and Resolution Architecture." More information here.

-

Dina Tedla published Ghana Business News Mentions Jubilee and Partners' Economic Advocacy Workshop in Press 2023-10-02 14:15:56 -0400

Ghana Business News Mentions Jubilee and Partners' Economic Advocacy Workshop

Ghana Business News highlights key proposals from Jubilee USA and partners' "The Role of FBIs and the Media in Securing an Inclusive Economic Recovery and Debt Relief" workshop in Accra, Ghana. Read an excerpt below, or the full article here.

Multi-Faith Network leaders call for transparency in IMF bailout funds utilisation

A Coalition of Multi-Faith Network leaders, has called for equity, inclusion, transparency, and good governance on the utilisation of the International Monetary Fund (IMF) bailout funds for Ghana.

The Coalition in a Communique read by Hajia Ayishetu Abdul-Kadiri, the Chairperson, Faith in Ghana Alliance, reiterated the importance of transparency, accountability and good governance in managing and utilising funds received through the IMF bailout.

The Communique, which was issued in Accra, at the end of an advocacy workshop for Faith-Based Institutions (FBIs), News Editors and Reporters said the resources’ responsible and ethical use would foster trust and confidence in the government’s commitment to inclusive economic recovery.

The workshop, organised by Caritas Ghana in collaboration with Caritas Africa and Jubilee USA Network was on the theme: “The Role of FBIs and the Media in Securing an Inclusive Economic Recovery and Debt Relief.”

Read more here.

-

Dina Tedla published Eric LeCompte Quoted in News24 on the Sustainable Development Goals in Press 2023-09-27 12:39:52 -0400

Eric LeCompte Quoted in News24 on the Sustainable Development Goals

News24 quotes Eric LeCompte on the Sustainable Development Goals and how public debt effects their achievement. Read an excerpt below, or the full article here.

The UN can talk SDGs all it wants, without money it means little for Africa, experts warn

By Lenin Ndebele

The UN General Assembly (UNGA78), currently underway, is spending much of its time on topics such as democracy, environmental protection, and the 2030 Sustainable Development Goals (SDGs).

But without money, that was just empty talk, experts have warned.

"In 2015, the international community won a historic agreement on goals to lift countries out of poverty and protect our planet," said Eric LeCompte, the executive director of religious development group Jubilee USA.

Defined as "a shared blueprint for peace and prosperity for people and the planet, now and into the future", the SGDs are a set of 17 interconnected goals.

Read more here.

-

Dina Tedla published News24 Quotes Eric LeCompte on Debt's Effects on Global Development Goals in Press 2023-09-27 12:22:07 -0400

News24 Quotes Eric LeCompte on Debt's Effects on Global Development Goals

News24 quotes Eric LeCompte on the G20 and countries' debt effects on reaching the Global Development Goals. Read an excerpt below and click here for the full story.

Africa in the G20: The good, the bad, and the changing climate

By Lenin Ndebele

Africa is the poorest and most climate-vulnerable region of the globe. And now it forms part of the powerful Group of 20 - technically making it the G21 - via the inclusion of the African Union (AU).

That, some believe, can change a lot of things.

"This membership, for which we have long been advocating, will provide a propitious framework for amplifying advocacy in favour of the continent and its effective contribution to meeting global challenges," said AU chairperson Moussa Faki Mahamat in a statement.

Africa's primary difficulties were addressed in the New Delhi Declaration, which marked what has been widely regarded as the most progressive G20 summit since the group was founded in 1999 to debate global economic and financial issues.

Read more here.

-

Dina Tedla published Executive Director Eric LeCompte Speaks With The Sanctuary For Independent Media On The NY Taxpayer and International Debt Crises Protection Act in Press 2023-06-20 14:13:04 -0400

Executive Director Eric LeCompte Speaks With The Sanctuary For Independent Media On The NY Taxpayer and International Debt Crises Protection Act

Eric LeCompte speaks with Mark Dunlea from Hudson Mohawk Magazine on the New York Taxpayer and International Debt Crises Protection Act (S4747, A2970). Listen to the full interview here.

Jubilee USA Pushes NY To Enact International Debt Relief Law

As the world’s leading financial center, NY law governs the majority of the developing world debt contracts. Third world debts have grown unsustainably large as COVID, climate change, and the war in Ukraine have worsened these nation’s financial conditions. Eric LeCompte of Jubilee USA Network explains how the NY Taxpayer and International Debt Crises Protection Act would help remedy this problem. With Mark Dunlea for Hudson Mohawk Magazine.

-

IMF and World Bank Meetings Conclude

Observers Assert that Meetings were Lost Opportunity

World leaders gathered for the annual IMF and World Bank Meetings, focused on the pandemic, Ukraine war and decades-high inflation impacting the global economy. The IMF downgraded growth and forecasted losses of $4 trillion between now and 2026. Neither the G20, nor the policymaking bodies of the IMF and World Bank, reached a consensus on statements.

"Russia's invasion of Ukraine dominated the meetings and prevented world leaders from reaching agreements to address the growing global economic crisis," noted Eric LeCompte, Executive Director of the religious development group Jubilee USA Network.

Multiple reports during the meetings focused on a likely global recession, economic downturns, inflation and climate challenges."It’s hard to believe that three years into the pandemic, the economic warnings from the IMF forecast greater problems to come,” said LeCompte. “It seems we will see a global recession.”

Developing countries struggle with high debts and interest rate hikes that drive up their debt payments.

"As interest rates rise to tackle inflation, we could see a number of defaults in developing countries,” added LeCompte. "The financial system does not have the tools to deal with multiple debt crises.”

Three countries applied for debt relief under a process agreed by the G20 last year and still have not received debt reductions. The Chair of the International Monetary and Financial Committee welcomed progress on the Zambia debt restructuring under the G20 Common Framework process.

"Beyond some progress on Zambia’s debt restructuring, which comes with significant delay, none of the signals the G20 provided today would encourage borrowers facing debt crisis to use the Common Framework,” stated LeCompte. "Lacking a predictable path for debt relief, indebted countries choose to postpone facing their debt problems."

IMF membership finalized details that allow a new vehicle, the Resilience and Sustainability Trust to begin loans. Three countries, Barbados, Costa Rica and Rwanda, already reached initial agreements to receive loans under the Trust, which takes Special Drawing Rights aid from wealthy countries to fund cheap climate and pandemic loans for vulnerable countries. The IMF also announced pledges of $40 billion in SDR contributions towards the Trust.

"With the Trust already in place, the G20 should focus on similar Special Drawing Rights funding to expand development bank lending," shared LeCompte.

In a statement to the meetings, Africa's Catholic Bishops and major faith leaders called for wealthy countries to rechannel a significant portion of their stock of more than $400 billion in Special Drawing Rights to African countries.

“We especially want to highlight, in our region, the enormous potential of rechanneling through the African Development Bank,” the faith leaders shared.

The IMF also passed a Food Shock Window – a temporary expansion in low-conditions, low-cost loans for countries dealing with food crises.

Members, on the other hand, did not make decisions on the IMF penalty rates for countries taking loans. The surcharges will cost 14 developing countries $8 billion in payments during 2021-2028.

"IMF penalty rates for countries taking loans should be suspended when so many countries need these loans for shocks that fall outside of their control,” stated LeCompte.

Finance ministers discussed proposals to increase development bank lending. US Treasury Secretary Janet Yellen called for development banks to devise new approaches to address global challenges without sacrificing their primary poverty-reduction goals.

"Responding to climate change and other global challenges means that development banks will need to do more,” said LeCompte. "At these meetings, we saw growing momentum to boost development banks so they can provide more aid and lending."

According to the IMF, developing countries will need $300 billion annually in additional funding to adapt to climate change. The World Bank estimates current climate finance amounts should quadruple.

"There is growing concern about the way the climate emergency disproportionately hurts the poor,” added LeCompte.

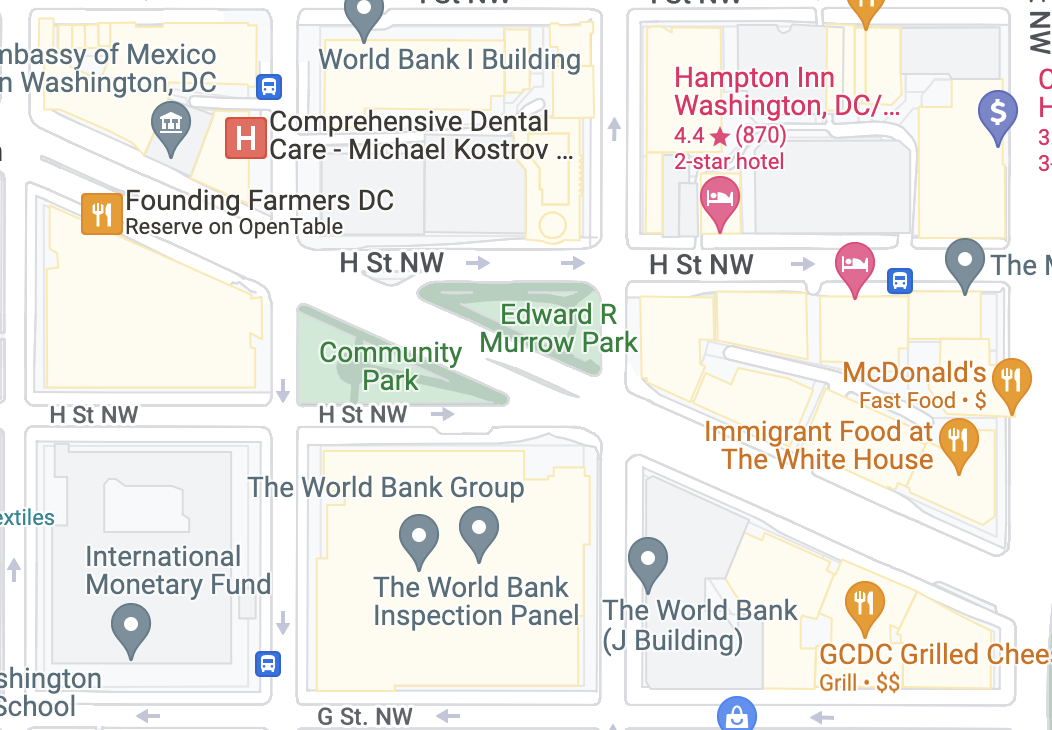

Jubilee USA, IMF and World Bank Vigil and Paper Chain Delivery: Saturday, October 15th, 11:30 AM, Community Park, outside of the IMF. The chains that we will display in front of the IMF and World Bank between 11:30 AM and noon, were made by churches and synagogues across the US to send messages of debt relief to world leaders. View the advisory here. Link to the online and in-person press registration here.Read the full African Catholic Bishops and religious leader statement here.

Read Jubilee USA's statement on the IMF and World Bank Annual Meetings here.

Read Jubilee USA's statement on the G20 Finance Ministers Meeting here.Read Jubilee USA's statement on the IMF World Economic Outlook report here.

Read Jubilee USA's statement on the Global Financial Stability Report here.

Read Jubilee USA's press release on IMF chief Kristalina Georgieva's curtain-raiser speech here.

Read Jubilee USA's press release on the IMF Food Shock Window here.

-

Dina Tedla published Press Advisory: Jubilee USA Holds IMF/World Bank Meetings Vigil, Teach-In and Press Conference this Friday and Saturday in Press 2022-10-13 16:19:53 -0400

Press Advisory: Jubilee USA Holds IMF/World Bank Meetings Vigil, Teach-In and Press Conference this Friday and Saturday

Photo Opportunities of hundreds of paper chains and Sukkah Raising Friday and Saturday Outside IMF and World Bank (schedule below)

Jubilee USA, IMF and World Bank Press Conference

Friday, October 14th, 2:15 PM

(Press RSVP to receive Facebook live link and ask questions online)Who:Reverend Dr. Susan Henry-Crowe, General Secretary, The United Methodist Church General Board of Church and Society; Patricia Miranda, Latin American Network on Social and Economic Justice; Eric LeCompte, Executive Director, Jubilee USA Network

What:Religious and development leaders hold a press conference, vigil and teach-in to comment on the IMF, World Bank, G7 and G20 meetings. The annual meetings are where consequential decisions affecting billions of people and our planet are made. In the face of shocks from the Ukraine war, the pandemic and food crisis, religious and development groups call on world leaders to support jobs, vaccine distribution, debt relief, economic aid and climate change solutions.Where:Outside IMF and World Bank, Community Park 1824-1884 H St NW, Washington, DC 20006.

Schedule for Friday, October 14th- 10:00 AM: Raising the Sukkah

- 2:00 PM: Opening Prayer Service

- Reverend Dr. Susan Henry-Crowe, General Secretary, The United Methodist Church General Board of Church and Society

-

2:15 PM: Press Conference

- 2:45 PM: Teach-In

- Ktjel Abildnes, Norwegian Church Aid

- Elise Bean, Director, Washington Office of Levin Center, Wayne Law, author and former lead investigator for Senator Carl Levin

- Daniela Berdeja, Latin American Network on Social and Economic Justice

- Tom Cardamone, Global Financial Integrity

- Imani Countess, US/Africa Bridge Building Project

- Iolanda Fresnillo, European Network on Debt and Development

- Tim Jones, Debt Justice UK

- Matti Kohonen, Financial Transparency Coalition

- Richard Kozul-Wright, Director, Globalization and Development Strategies Division, United Nations Conference on Trade and Development (UNCTAD)

-

Katherine Marshall, Interfaith 20 and Berkley Center on Religion, Peace and World Affairs

-

Matthew Martin, Debt Relief International

-

Patricia Miranda, Latin American Network on Social and Economic Justice

-

Rick Rowden, American University

- Ktjel Abildnes, Norwegian Church Aid

- 5:15 PM: Closing Prayer Service

- Susan Gunn, Director, Maryknoll Office for Global Concerns

Schedule for Saturday, October 15th- 9:00 AM: Vigil

- 12:00 PM: Break the Chains of Debt: Paper Chains and Messages Delivered to IMF and G20

-

Dina Tedla published IMF and World Bank Interfaith Vigil, Press Conference and Teach-in in Press 2022-10-06 17:56:31 -0400

IMF and World Bank Interfaith Vigil, Press Conference and Teach-in

Protecting Lives, Livelihoods and Planet

October 14-15, 2022

World leaders will gather in Washington, DC for G20, G7, IMF and World Bank Meetings from October 10th - October 16th. At these meetings, they will make consequential decisions affecting billions of people and our planet. In the face of shocks from the Ukraine war, the pandemic and food crisis, we are calling on world leaders to support jobs, vaccine distribution, debt relief, economic aid and climate change solutions.

Join us on Friday, October 14th for a vigil, teach-in and press conference outside of the IMF, World Bank and G20 Meetings. Hear how religious and community leaders from around the world are working for a Jubilee. On Saturday morning, October 15th, we will bring thousands of paper chains to the IMF calling for debt relief and economic aid.

To stay up to date on all of the events please register at the link below. If you have any questions feel free to contact [email protected] or [email protected].Where:Outside IMF and World Bank, Community Park 1824-1884 H St NW, Washington, DC 20006.

Schedule for Friday, October 14th- 10:00 AM – 11:45 AM: Raising the Sukkah

- Elise Bean, Director, Washington Office of Levin Center, Wayne Law, author and former lead investigator for Senator Carl Levin

- Abby Nash, Senior Director of Campaigns, Jubilee USA Network

- Yolanda Savage-Narva, Assistant Vice President, Racial Equity, Diversity, and Inclusion (REDI) for the Union for Reform Judaism

- Damon Silvers, Special Counsel and Senior Adviser, Jubilee USA Network

- Elise Bean, Director, Washington Office of Levin Center, Wayne Law, author and former lead investigator for Senator Carl Levin

- 2:00 PM: Opening Prayer Service

- Reverend Dr. Susan Henry-Crowe, General Secretary, The United Methodist Church General Board of Church and Society

- Reverend Dr. Susan Henry-Crowe, General Secretary, The United Methodist Church General Board of Church and Society

- 2:15 PM: Press Conference

- Reverend Dr. Susan Henry-Crowe, General Secretary, The United Methodist Church General Board of Church and Society

- Patricia Miranda, Latin American Network on Social and Economic Justice

- Eric LeCompte, Executive Director, Jubilee USA Network

- Reverend Dr. Susan Henry-Crowe, General Secretary, The United Methodist Church General Board of Church and Society

- 2:45 PM: Teach-In

Speakers include:

- Ktjel Abildnes, Norwegian Church Aid

- Daniela Berdeja, Latin American Network on Social and Economic Justice

- Aldo Caliari, Senior Director of Policy and Strategy, Jubilee USA Network

- Tom Cardamone, Global Financial Integrity

- Imani Countess, US/Africa Bridge Building Project

- Iolanda Fresnillo, European Network on Debt and Development

- Tim Jones, Debt Justice UK

- Gary Kalman, Executive Director, Transparency International U.S.

- Matti Kohonen, Financial Transparency Coalition

- Richard Kozul-Wright, Director, Globalization and Development Strategies Division, United Nations Conference on Trade and Development (UNCTAD)

-

Katherine Marshall, Interfaith 20 and Berkley Center on Religion, Peace and World Affairs

-

Matthew Martin, Debt Relief International

-

Patricia Miranda, Latin American Network on Social and Economic Justice

-

Rick Rowden, American University

- Ktjel Abildnes, Norwegian Church Aid

- 5:15 PM: Closing Prayer Service

- Susan Gunn, Director, Maryknoll Office for Global Concerns

Schedule for Saturday, October 15th- 9:00 AM - 12 PM: Vigil

- 12:00 PM: Break the Chains of Debt: Paper Chains and Messages Delivered to IMF and G20

- 10:00 AM – 11:45 AM: Raising the Sukkah

-

IMF Provides Emergency Food Crisis Loans

The IMF launches the Food Shock Window to aid countries facing food shortages by expanding access to rapid, low-interest loans. The number of people facing food shortages rose by more than 200 million since the pandemic.

“All over the world people are struggling with food shortages because of the pandemic, the Ukraine war and soaring prices spurred by inflation,” said Eric LeCompte, Executive Director of Jubilee USA. "The IMF's action helps countries wrestling with food crises."

In 45 countries, 50 million people are on the verge of famine, the World Food Programme reported.

“The growing global food crisis can push countries into social unrest and instability,” added LeCompte. “While the Food Shock Window helps, it is only buying time. More loans as many countries struggle to pay debts is not a long-term answer."

Sixty per cent of the poorest countries and 30 per cent of developing middle-income ones are at risk of debt crises.

-

Dina Tedla published Religious Leaders: New York Debt Bill Helps Solve Economic Crises in Developing Countries in Press 2022-09-14 18:49:40 -0400

Religious Leaders: New York Debt Bill Helps Solve Economic Crises in Developing Countries

New York and US Taxpayers, Global Economy Benefit from Legislation

Religious and labor leaders explained that New York laws can provide debt relief for countries struggling from the pandemic and shocks from the Ukraine war. Speaking at a press conference in the New York State Capitol Building, they expressed support for legislation introduced by Assemblymember Patricia Fahy, Chair of the Banks Committee.

“New York is the world’s global financial hub — positioning us well to enact basic changes that will ensure debt relief for developing nations through investments in sustainable growth, infrastructure and more,” said Fahy. “Not only will this legislation protect U.S. taxpayers, it will spur new development and growth within the global economy, reduce stress on international supply chains, and establish clear strategies for growth in nations burdened by massive amounts of debt.”

The New York Taxpayer and International Debt Crises Protection Act (A. 10595) ensures private creditors participate in debt relief initiatives at the same level as the US government, other governments and other creditors. Over 50% of the world's debt held by private creditors is contracted under New York State law.

“The pandemic pushed many developing countries into debt and economic crises,” stated Eric LeCompte, Executive Director of the religious development organization Jubilee USA Network. “Countries can get help resolving debt crises under New York law and the new legislation ensures countries get the relief they need. Because we trade with these countries, resolving debt crises helps resolve supply and economic shocks that we face at home.”

At 7:00 PM ET, Jubilee USA Network hosts a panel discussion featuring Fahy and LeCompte. Speakers include, Rabbi Matthew Cutler, Congregation Gates of Heaven Synagogue; Rev. Dustin Longmire, Messiah Lutheran Church of Schenectady, New York, and former President of the New York Council of Churches; Rev. Nicolle D. Jean-Simon, Pastor of Duryee Memorial African Methodist Episcopal Zion Church and NAACP President of Schenectady Branch #2175; Rev. Dr. Amaury Tanon-Santos, Executive Director of Schenectady Community Ministries and President of the Labor Religion Coalition of NY State; and Ron Deutsch, Executive Director of New Yorkers for Fiscal Fairness.

Watch livestream event “Funding Food, Vaccines and the Environment in Developing Nations,” at 7:00 PM ET.

Read NYS Assemblymember Patricia Fahy’s Office Press Release here.

View the NY Taxpayer and International Debt Crisis Protection Act and Bill Memo here.

Read a previous Jubilee USA press release on the bill here.

-

Dina Tedla published Executive Director Eric LeCompte Speaks with Madison Public Radio on Student Debt Cancellation in Press 2022-09-01 13:37:50 -0400

Executive Director Eric LeCompte Speaks with Madison Public Radio on Student Debt Cancellation

Eric speaks with WORT 89.9 a Madison, WI public radio on student debt cancellation. Hear the full interview here.

LeCompte: How Student Debt Cancellation Affects Communities

-

Dina Tedla published Annual Federal Reserve Wyoming Meeting Hosts Central Bank Heads to Improve Global Economy in Press 2022-08-25 15:24:46 -0400

Annual Federal Reserve Wyoming Meeting Hosts Central Bank Heads to Improve Global Economy

Inflation, Recession and Developing Country Debt Top Agenda of Jackson Hole Meeting

The future of interest rates and the threat of stagflation – a phenomenon where the economy and jobs shrink while inflation rises -- dominate the agenda at a three-day global central bank retreat starting on Thursday. This year’s traditional Jackson Hole, Wyoming symposium gathers the US Federal Reserve and other world central banks under the theme "Reassessing Constraints on the Economy and Policy."

“The meeting is focused on trying to tame inflation without causing more harm for developing countries in crisis,” said Eric LeCompte, Executive Director of the development group Jubilee USA Network. “We are reminded by the challenging decisions world leaders faced with the economy in the 1970s. At this point with greater threats to the global economy, we are in uncharted waters."

The US Federal Reserve raised interest rates more than two percentage points since the beginning of the year and consumer prices rose the fastest in four decades. The combination of interest rate increases and a strong dollar raises debt levels in developing countries. In July the IMF reported that debt in 60 percent of the poorest countries and 30 percent of emerging middle-income economies reached critically-high levels.

“While lowering inflation is important, we need to keep in mind the global impacts of increased debt, food crises and supply shocks that can undermine the economic stability we hoped to achieve through lower inflation,” shared LeCompte.

On Friday, Federal Reserve Chair Jerome Powell addresses the Jackson Hole meeting.

-

Dina Tedla published Biden Cancels Student Debts and Extends Loan Payment Suspension in Press 2022-08-25 14:53:53 -0400

Biden Cancels Student Debts and Extends Loan Payment Suspension

The Biden Administration announced plans to cancel $10,000 in student debt for borrowers earning under $125,000 a year. Borrowers who received a college federal Pell grant, given to students that have the greatest need, qualify for up to $20,000 in student debt relief. The White House action extended a freeze on student loan payments that President Trump initiated in 2020 as part of pandemic relief. This is the fifth time President Biden continued the moratorium on student debt payments.

“President Biden’s historical student debt cancellation is a bold step that goes beyond previous support and will help vulnerable communities,“ said Eric LeCompte, Executive Director of religious group Jubilee USA Network. LeCompte's organization advocated for the student relief measures with the Biden and Trump White House. “Soaring food and gas prices are putting more pressure on vulnerable communities still reeling from the pandemic.”

Jubilee USA mobilized thousands of messages to Congress and the Trump and Biden White Houses urging student debt relief to help confront the economic crisis spurred by the coronavirus.

“While the student loan forgiveness helps those hit by the pandemic and inflation, more student debt relief will be needed,” added LeCompte.

-

Dina Tedla published G20 Finance Ministers Meeting Focuses on Response to Global Economic Crises in Press 2022-07-15 09:44:33 -0400

G20 Finance Ministers Meeting Focuses on Response to Global Economic Crises

On Friday, G20 finance ministers descend on Bali, Indonesia, to discuss a global economy impacted by the pandemic, Ukraine war, high country debt levels and rising inflation. Food shortages, climate and tax issues will also be on the agenda at the two-day talks.

“Developing countries lack the resources to confront economic crises and food shortages,” said Eric LeCompte, Executive Director of the religious development group Jubilee USA Network. “The G20 must act quickly to prevent a recession and address food and debt crises."

The World Bank warns that due to the impacts of the pandemic and the Ukraine war, average incomes in 40% of developing countries will remain below 2019 levels.

"Rising interest rates mean developing countries have higher debt payments just when they need to invest more to protect their people,” added LeCompte. “Countries need debt relief, not more debt."

Three countries applied to a G20 debt reduction process created in 2020 and have yet to see any debt relief.

-

Dina Tedla published G7 Summit Focuses on Global Crisis Response, Ukraine War, Food Security and Climate in Press 2022-06-28 10:43:39 -0400

G7 Summit Focuses on Global Crisis Response, Ukraine War, Food Security and Climate

Leaders Urge Debt Relief for Developing Countries

African Religious Groups Call on G7 to Address Poverty

In a concluding statement of the G7 Summit in the Bavarian Alps, the group addressed the global economy, the COVID crisis, the Ukraine war, climate, debt and vaccines. Presidents and prime ministers of the G7 highlighted the urgency to improve debt relief frameworks and address debt vulnerabilities.

"Debt relief is critical as developing countries struggle with the pandemic and food shortages due to the Ukraine war," said Eric LeCompte, Executive Director of Jubilee USA Network. “The G7 noted the importance for China and the private sector to participate in debt relief processes so developing countries can withstand current crises."

Up to 73 of the world’s poorest countries can seek debt relief through a G20 process. To date, Chad, Ethiopia and Zambia applied for the debt relief framework.

"The G20 debt relief process needs to be implemented more quickly," stated LeCompte. "We need the process expanded to cover other countries in need like Sri Lanka."

In May, the New York State Assembly began consideration of a bill that requires private creditors, which hold the majority of developing country debt, to join in relief deals. The legislation would apply to the more than 50% of the world's private debt contracts because they are issued under New York law.

“Legislation adopted by G7 countries can ensure the private sector and commercial banks participate in debt relief,” added LeCompte.In a statement addressed to G7 leaders, the Justice, Peace and Development Commission of the Catholic Symposium of Episcopal Conferences of Africa and Madagascar (SECAM) warned about the deteriorating debt situation on the continent.

“Worsening global conditions and rising interest rates will push more African countries to make impossible choices between saving lives and jobs or paying creditors,” stated Bishop Sithembele Siphuka, First Vice-President of SECAM and Commission Chair.

The G7 launched an infrastructure plan that plans to tackle developing countries taking on too much debt. Pledging $600 billion in developing country infrastructure by 2027, the terms and quality of projects under the Global Partnership for Infrastructure and Investment seek to keep debt levels in check.

"The G7 plan to invest in countries from Angola to the Ivory Coast means less debt and positive economic returns for developed and developing countries,” shared LeCompte. "The G7's investment in sustainable infrastructure is good news for developing countries."

Leaders focused on the global food crisis pledging an additional $4.5 billion to protect the vulnerable from hunger and malnutrition. The war in Ukraine worsened food shortages and more than 193 million people face hunger.

On climate, the G7 announced the creation of a “Climate Club." The club or group of countries would focus on actions to meet climate goals. The G7 renewed pledges to deliver $100 billion in annual funds to address climate change through 2025.

"The Ukraine war, pandemic and climate crisis are a triple threat that developing countries don't have the resources to combat,” expressed LeCompte.

Read the full G7 communiqué here.

Read the African Catholic Bishops' statement to G7 leaders here.

Read Jubilee USA's press release on the New York Taxpayer and International Debt Crises Protection Act here.

Read Jubilee USA's press release on the G7 finance ministers meeting here.

-

Dina Tedla published G7 Summit Focuses on Ukraine War, Pandemic, Climate, Vaccines and Debt in Press 2022-06-24 15:36:29 -0400

G7 Summit Focuses on Ukraine War, Pandemic, Climate, Vaccines and Debt

Gathering in Bavarian Alps, President Biden and G7 Prime Ministers Confront Global Inflation, Food Security and Economic Crises

On Sunday, G7 presidents and prime ministers begin their three-day summit under the German Presidency. Meeting at the Schloss Elmau resort, the leaders deliberate on the pandemic, Ukraine war, food shortages, vaccines and climate issues.

“We are dealing with crisis on top of global crisis,” shared Eric LeCompte, Executive Director of the religious development group Jubilee USA Network and a United Nations finance expert. “Most countries were struggling to get through the pandemic and couldn't confront the challenges of climate change. Now the Ukraine war is creating a growing food crisis for many of those same countries.”

In a petition to G7 leaders, more than 50 African religious leaders asked for relief measures for the continent struggling with food, climate and health crises. Jubilee USA worked with religious leaders in Africa on the statement. Signers of the statement include Bishops and representatives from the Catholic Symposium of Episcopal Conferences of Africa and Madagascar, Caritas Africa, the Church of Pentecost in Ghana and the All Africa Conference of Churches. In addition to other measures, the religious leaders requested “debt relief initiatives for African countries, and . . . measures, including domestic legislation, to compel full public and private creditor participation and transparency.”

Legislation currently before New York State lawmakers requires private creditors to provide debt relief at the same level that governments and public institutions provide to struggling countries. More than 60% of developing country debt is in private sector hands.

“Inflation, economic shocks and food shortages are all tied to the debt crises developing countries are facing,” stated LeCompte. “The single most meaningful commitment the G7 could make is to support legislation in G7 countries that ensures private and commercial lenders contribute to debt relief."

While debt and inflation will be key focuses of the upcoming meetings, leaders are set to endorse a global initiative for food security and a plan to address climate change.

“G7 countries hold about $400 billion in emergency pandemic currency that could be given to development banks and used to tackle climate and food challenges,” noted LeCompte.

The International Monetary Fund created $650 billion in emergency currency known as Special Drawing Rights for coronavirus relief last year. The majority of these funds were received by developed countries who can donate the funds to developing countries. Several of these wealthy countries pledged $60 billion of their Special Drawing Rights to fund IMF cheap loans to developing countries.

Read the African religious leaders' petition to G7 leaders here.

Read Jubilee USA's press release on the New York Taxpayer and International Debt Crises Protection Act here.

Read Jubilee USA's press release on the G7 finance ministers meeting here.

-

Dina Tedla published African Religious Leaders Release Statements in the Occasion of G7 Schloss Elmau Summit in Press 2022-06-24 15:14:04 -0400

-

Dina Tedla published World Trade Organization Vaccine Decision Won't Do Enough to Address the Pandemic in Developing Countries, Says Development Group in Press 2022-06-17 14:52:30 -0400

World Trade Organization Vaccine Decision Won't Do Enough to Address the Pandemic in Developing Countries, Says Development Group

Ministers of World Trade Organization (WTO) member countries agreed on a limited waiver of COVID-19 vaccine patents to help developing countries acquire coronavirus vaccines.

“For countries struggling to protect their people against continued COVID outbreaks, this decision won't do enough," said Eric LeCompte, Executive Director of the religious development group Jubilee USA. “After more than two years of a pandemic that cost millions of lives, developing countries need a suspension of multiple WTO rules in order to boost access to vaccines, tests and treatments."

Meeting for the first time since 2017, the WTO Ministerial lasted an additional day due to difficulties in achieving a consensus. In certain circumstances, the new decision allows developing countries to make vaccines without having to seek the vaccine patent owner’s approval. Development groups argue that similar vaccine approvals already largely exist, in WTO rules before this deal.

The International Monetary Fund estimates that more than 100 countries will fail to reach vaccination targets to contain the pandemic globally. WTO members agreed to negotiate possible extensions of the waiver for tests and treatments within six months.

“Tests and treatments should have been part of the same package," added LeCompte. "Access to tests, treatments and vaccines is essential to limit the threat of new and deadlier mutations that can affect all of us.”

-

Dina Tedla published Aldo Caliari Discusses NY Private Creditor Debt Legislation in Financial Times in Press 2022-06-16 08:29:42 -0400

Aldo Caliari Discusses NY Private Creditor Debt Legislation in Financial Times

In a letter that appeared in the Financial Times, Aldo Caliari, Senior Director of Policy and Strategy, explains how the recently-introduced NY Taxpayer and International Debt Crises Protection Act could bind private creditors into sovereign debt restructurings, and why we need it. Read the full letter here.