G20 finance ministers conclude their meetings during the Annual IMF and World Bank Meetings. The ministers focused on the pandemic, Ukraine war and inflation shocks to the global economy, debt vulnerabilities in developing countries, food insecurity and the climate crises.

Eric LeCompte, Executive Director of the religious development group Jubilee USA Network and a United Nations finance expert who has monitored G20 and IMF meetings since 2010, releases the following statement on the G20 finance ministers meeting:

"The G20’s internal rifts prevent the group from responding to multiple crises.

"As interest rates rise to tackle inflation we could see a number of disorderly defaults in developing countries.

"The financial system does not have the tools to deal with multiple debt crises.

"The G20 debt relief process has not, yet, passed key tests showing it can be speedy, reduce debt and involve the private sector.

"Beyond the progress on Zambia’s debt restructuring, which comes with significant delay, none of the signals the G20 provided today would encourage borrowers facing debt crisis to use the Common Framework.

"IMF penalty rates for countries taking loans should be suspended when so many countries need these loans for shocks that fall outside of their control.

"Food price inflation and the pandemic shocks led to a rise of 200 million people going hungry in the last two years.

"The IMF Food Shock Window that expands cheap loans to deal with the food crisis is important, but only a temporary and limited relief measure.

"The G20-commissioned expert group made proposals to expand development bank lending.

"It's up to the G20 to decide which proposals to implement that could yield hundreds of billions of dollars to respond to global challenges.

"The G20 gave the green light to the Resilience and Sustainability Trust to provide long-term, cheap loans for pandemic and climate reforms in poor countries.

"Wealthy countries can donate their Special Drawing Rights to the Resilience and Sustainability Trust.

"With the Trust already in place, the G20 should focus on similar Special Drawing Rights funding to expand development bank lending."

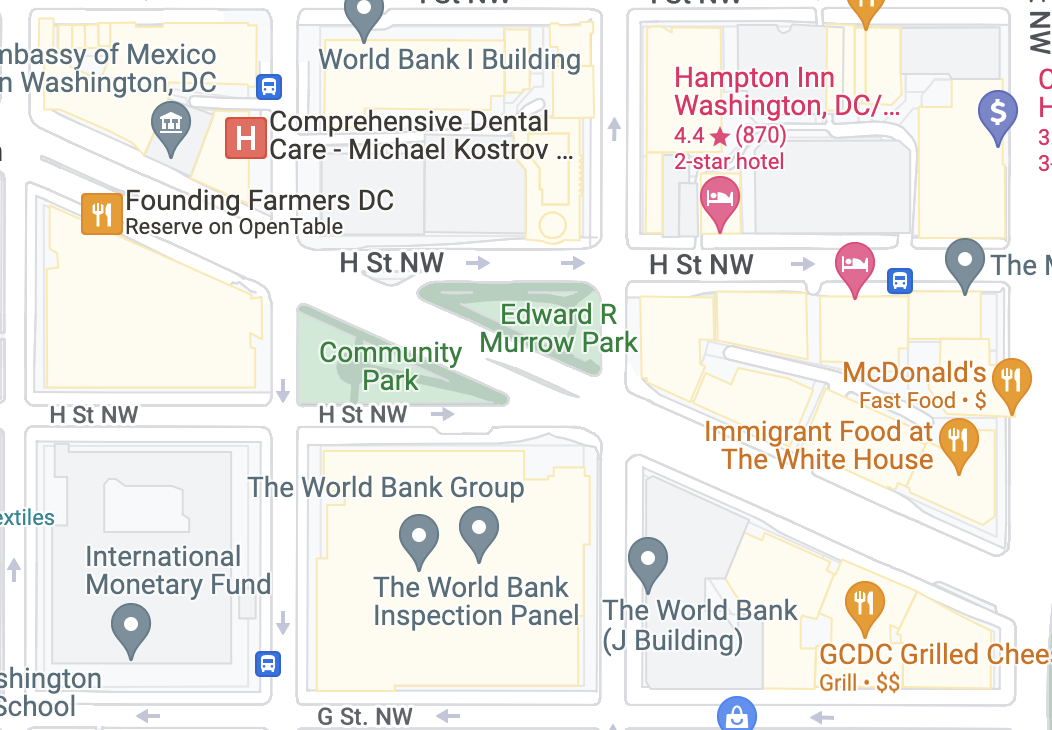

Join us for a Jubilee USA, IMF and World Bank Press Conference: Friday, October 14th, 2:15 PM, Community Park Outside of IMF, view advisory and online and in-person press registration. (Link to registration here).

Find Jubilee USA's October 14th and 15th interfaith vigil, press conference and teach-in details here.

Read Jubilee USA's press release on the World Economic Outlook and Global Financial Stability reports here.

Read Jubilee USA's press release on IMF chief Kristalina Georgieva's curtain-raiser speech here.

Read Jubilee USA's press release on the IMF Food Shock Window here.